Large Banks are winning with Customer Experience

The largest of the Banks in the United States are winning over the Millennial generation with superior tools and client experiences. This is the same generation that is turning away from vehicle ownership and suburban homes in favor of vehicle share and Uber in urban environments where walkability is key. One would think that after the great recession and the public ire that was focused on too-big-to-fail that consumers, including the counter-culture portion of the Millennial generation, would turn to community banks and smaller financial institutions. However this is the same generation that covets exceptional customer experiences and it is the large financial institutions that have proven to have the wallets and vision needed to execute around such experiences.

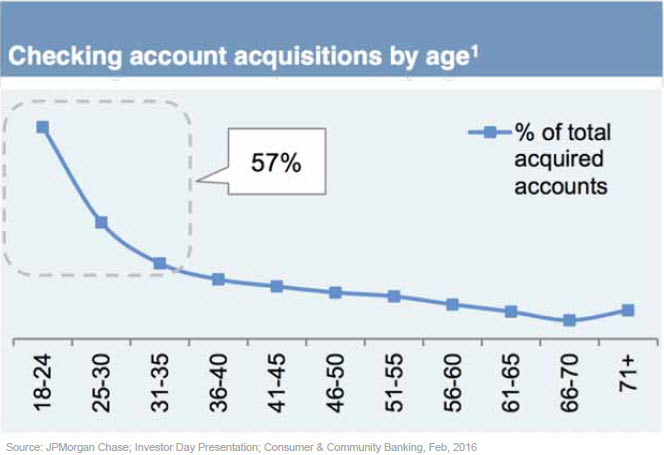

Just look at Chase's account origination statistics broken down by age group. 57% of new accounts were from the Millennial generation. A group of new clients that will go on to inherit an unprecedented amount of wealth. Chase is doing this by provide the basics of online account origination, money movement, mobile remote deposit capture and more services wrapped in a client experience that uses well orchestrated mobile and traditional website interfaces along with text messaging and advanced interfaces like Amazon's Alexa or Apple's Siri. Chase is furthering the experience with purchasing the technology to implement the likes of Chase Pay and Zelle as well as other up-and-coming Apps. Note that in 2016 Chase invested $9.6 billion on technology of which $600 million was spend on fintech.

In the end customer experience trumps customer service. So while your smaller financial institution might be able to provide more personable customer service, and you may say that customer service is your competitive advantage, I challenge whether that is true or, if you can convince me it is true, whether it is sustainable. The questions I leave you with:

- Do you have the financial products and services wrapped into the experience needed to compete?

- Do you have the organizational culture required to embrace the creation and deployment of products and services and the expertise needed to wrap those products and services with at least an adequate customer experience if not superior customer experience?

- Can you maximize your limited resources to provide a great experience and then brand yourself in such a way as to win "fans" and loyalty?

Let me help evolve your financial institution! Whether in technology leadership, product leadership, operations leaders or more. Lean how my years of leadership and experience sitting at the intersection of business and technology can help your financial services company compete. Click here to learn more about my background.